As the old Wall Street adage goes, health care tends to underperform the stock market in presidential election years — and in recent cycles, that’s been true. But, there’s reason to believe this year that many health-related stocks, led by Eli Lilly , could defy historical convention. The S & P 500 Health Care Sector index has outperformed the broader S & P 500 in just three of the past eight presidential election years dating back to 1992, according to FactSet data. That’s equal to just 38% of the time. By contrast, when considering all years since 1992, health care has outshined the S & P 500 more than half of the time — 18 out of 32. So far in 2024, health care has been the best-performing sector in the S & P 500, climbing roughly 2%. The overall broad market index has dropped around 1% year to date. .GSPHC .SPX YTD mountain Health care sector vs. S & P 500 YTD It’s way too early for any grand predictions with Election Day 2024 about 10 months away. Nevertheless, we see attractive fundamentals in the year ahead for a host of health-care stocks, giving us the confidence to own Lilly, GE Healthcare and Danaher despite what history says about the group in presidential election years. Last week , we added Abbott Laboratories , Amgen , Novartis , and Walgreens Boots Alliance to our stock watchlist, known as the Bullpen. Jim Cramer interviewed the CEOs of all four companies at last week’s JPMorgan Healthcare Conference in San Francisco. “Health care may be a real challenger to tech this year, a business that can actually grow faster than most of tech and has the possibility of a comeback from the Covid straitjacket that so many of these companies got caught up in,” Jim wrote in his weekly column on Monday . In general, the reason investors tend to be more cautious about the health-care sector in presidential election years is tied to rhetoric and policy uncertainty. Of course, the specifics of each election may differ. However, the cost of prescription drugs and health insurance in the U.S. tends to be a point of discussion for politicians, which can make some investors wary about committing money to stocks in an industry under critical rhetorical fire. Consider that Sen. Bernie Sanders of Vermont, a leading candidate for the 2020 Democratic presidential nomination, had a “Medicare for All” proposal at the center of his campaign. While Joe Biden eventually overtook Sanders as the Democratic nominee (and ultimately became president), Sanders’ early strength in polls had ripple effects on health insurance stocks on Wall Street . .GSPHC .SPX mountain 2022-12-30 Health care sector vs. S & P 500 since 2023 Last year, the health-care sector lagged the S & P 500 by a wide margin — up 0.3% compared with a 24.2% advance for the overall index. After a strong 2022 for health care in a terrible overall market, investors last year placed a lower emphasis on the defensive characteristics of health care. Without the 59% gain from Eli Lilly, which is now the most valuable health-care company in the S & P 500, the sector’s performance in 2023 would’ve been even worse. The recent disparity has created a situation where valuations look pretty attractive across most industries within health care, including many pharmaceutical and medical device companies, according to Damien Conover, director of health-care research at Morningstar. “We think it’s a great time to take advantage of it,” he argued in an interview. It’s difficult to predict whether the U.S. economy is going to “keep growing really well, or maybe dip down, but either way health care I think is well-positioned on a valuation standpoint,” Conover said. “In a lot of cases, especially big biopharma and some device companies, you get a nice [dividend] yield, as well.” In recent election cycles, drug companies have been a prominent target for politicians. However, Conover suggested that rhetoric around the group may take on a different tone in 2024 due to provisions in the Inflation Reduction Act, or IRA. The August 2022 law — championed by Biden and other Democrats — gave the agency that runs Medicare the ability to negotiate drug prices with manufacturers and implemented a yearly out-of-pocket cap on prescription drug costs for those enrolled in the government health program for seniors. Politicians may continue to criticize drug companies, Conover cautioned, but the magnitude this cycle may be reduced with the IRA on the books. “With valuations as low as they are, usually when we see low valuations and high rhetoric, it usually doesn’t do much,” he added. “Even if the rhetoric is higher than what I’m anticipating, I think that is partially a stabilizer.” LLY 1Y mountain Shares of Eli Lilly over the past 12 months. Eli Lilly remains the Club’s favorite pharmaceutical stock, based on our confidence in its stellar drug pipeline to fuel multiple years of above-industry revenue growth. Even after its 2023 success, Lilly’s stock is worth owning in 2024 amid the rollout of the company’s obesity drug Zepbound. Its experimental Alzheimer’s drug, donanemab, also may soon receive approval from U.S. regulators approval, representing another catalyst . With the stock up about 8% already to start 2024 and hovering near record levels, we maintain a 2 rating on Eli Lilly shares, meaning we’d wait for a pullback before adding to our position. For his part, Conover told CNBC he believes Eli Lilly’s stock is “starting to look overvalued,” prompting Morningstar to have a bit more cautious view on the stock right now. Shares of Eli Lilly currently trade at roughly 50 times forward earnings estimates, according to FactSet. That’s higher than the health-care sector P/E multiple of 18.5 and the S & P 500’s 19.5. The two drugmakers added to our Bullpen last week, Amgen and Novartis, carry a forward price-to-earnings ratio of around 15. While there’s no guarantee Bullpen stocks get added to our portfolio, both companies represent interesting investment ideas — a reflection of our view that opportunities within health care exist in this election year. Amgen has completed its takeover of Horizon Therapeutics and may emerge as the No. 3 player in obesity drugs behind the two dominant players, Eli Lilly and Wegovy maker Novo Nordisk . Meanwhile, Novartis has a robust share purchase program, boasts a dividend yield above 3% and has reshuffled its portfolio in recent years to focus on innovative drugs in areas such as cardiovascular health and immunology. Life-sciences firm Danaher and medical equipment provider GE Healthcare look compelling to own in 2024. At a high level, both operate in industries that are less sensitive to election rhetoric and policy proposals, which is a favorable spot to be in. But there are other reasons to like the stocks. DHR 1Y mountain Danaher 1 year Danaher finally looks primed to move past the customer inventory overhangs that plagued its financials last year — it was one of the stocks locked into what Jim called the “Covid straitjacket,” as pandemic-era ordering habits normalized. Specifically, we’re looking for Danaher’s bioprocessing business to return to growth in the second half of this year. Plus, a pickup in biotechnology deal activity and potentially lower interest rates from the Federal Reserve could help Danaher’s customers have more money to spend on the company’s tools and products used in the drug development process. Addressing the life-sciences tools industry, Morningstar’s Conover said, “Valuations in that space look pretty good as the market during the pandemic got overly optimistic, and now they’re overly pessimistic.” GEHC 1Y mountain GE Healthcare 1 year GE Healthcare has fallen more than 10% over the past six months, but our outlook for the company hasn’t been shaken. Management remains committed to expanding margins now that the MRI and CT scan maker has been spun off by General Electric . Additionally, the continued rollout of Alzheimer’s drugs — Biogen and Eisai ‘s Leqembi and perhaps soon Lilly’s donanemab — may eventually boost demand for GE Healthcare imaging machines to help determine who should be on the drugs and to monitor the brains of patients once they’re receiving the therapy. The company’s ability to further enhance its products with artificial intelligence, making them more attractive for hospitals and other care providers, is a potential tailwind. HUM 1Y mountain Humana 1 year At this moment, the health-care stock we’re most cautious about is Medicare Advantage giant Humana , which has become “a very difficult stock to own,” Jim wrote earlier Wednesday . That is due, in part, to results from rival UnitedHealth Group , which last week reported fourth-quarter results that indicated more seniors were utilizing medical services. Investors saw the trends at UNH as worrisome for Humana, pushing its stock down 3.6% on Friday alone. However, including a 2% jump Wednesday and a flat Tuesday, Humana has recovered some of Friday’s losses. The situation on utilization — reflected in an industry metric known as the medical loss ratio — remains fluid for Humana ahead of the company’s own fourth-quarter results due out Feb. 5. Before UNH’s earnings report, Morningstar’s Conover told CNBC he was most cautious on health insurance stocks in 2024, saying that group faces “a little more headwinds” than others. For example, the growth rate for Medicare Advantage enrollment — a key focus area for Humana and other insurers — is likely to decelerate in 2024, he said. The Club still owns a small position in troubled Bausch Health , a Canadian pharmaceutical firm with multiple legal uncertainties. Our 4 rating on Bausch means we need more information before taking additional action. (Jim Cramer’s Charitable Trust is long LLY, DHR and GEHC. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

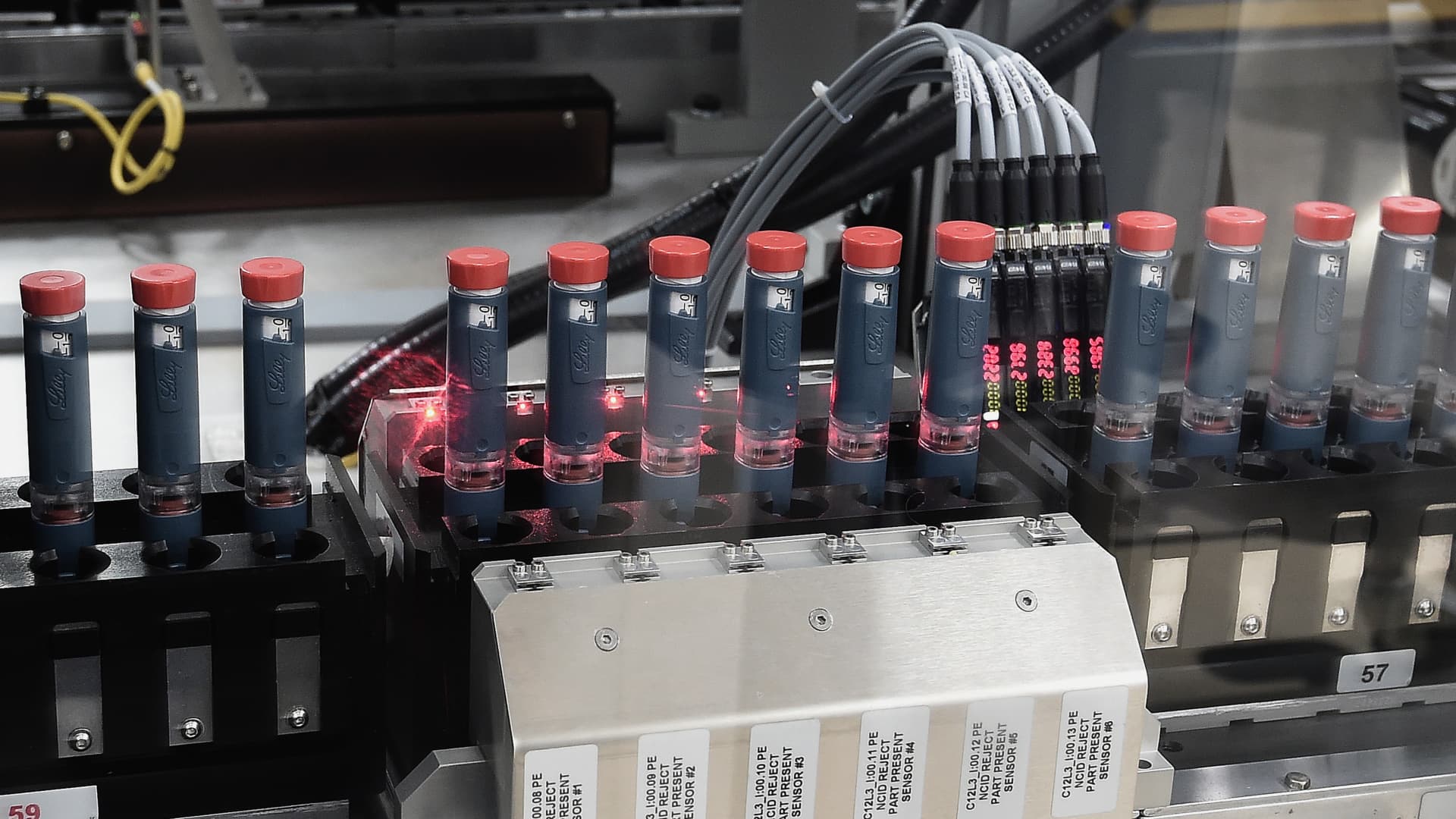

This picture shows an unit dedicated to the production of insulin pens at the factory of the US pharmaceutical company Eli Lilly in Fegersheim, eastern France.

Frederick Florin | AFP | Getty Images

As the old Wall Street adage goes, health care tends to underperform the stock market in presidential election years — and in recent cycles, that’s been true. But, there’s reason to believe this year that many health-related stocks, led by Eli Lilly, could defy historical convention.