CNBC’s Jim Cramer on Friday told investors what to look out for in the week ahead, and focused on companies whose earnings reports could lend insight into consumer spending.

Cramer also stressed the importance of understanding whether the Federal Reserve’s rate hikes are actually bringing down inflation.

“I think the averages are getting beaten down to the point where it’s a lot easier for us to rally, but until we see some signs that the Fed’s truly beaten inflation, it’s hard to get too excited about this market,” he said.

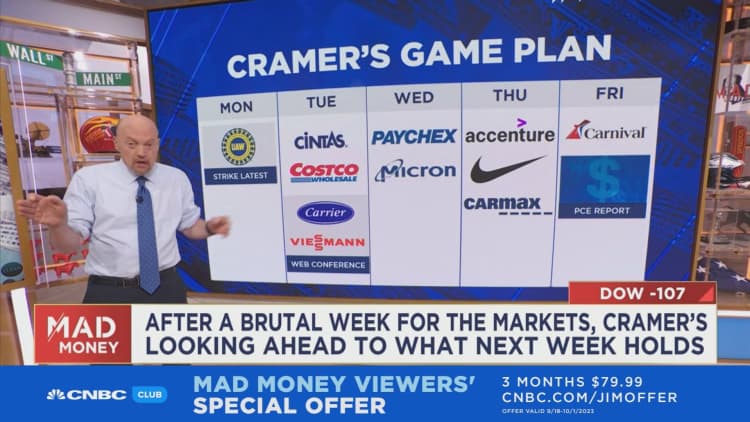

Cramer said he hopes on Monday there will be some concrete update on the United Auto Workers’ strike, perhaps a deal between Ford Motor and the union.

On Tuesday, Cintas and Costco report earnings. Cintas provides products like uniforms, mops and other equipment to businesses, and Cramer thinks the company could be a good barometer of small businesses because it does well when there’s more commerce. He thinks investors should also pay attention to whether Costco is seeing any kind of consumption slowdown to help gauge consumer spending.

Paychex, a payroll processors for small and medium-sized businesses, reports earnings on Wednesday. Until companies like Paychex start reporting stalled business, don’t expect the Fed to let up on its rate hikes, Cramer cautioned.

On Thursday, Cramer will look for the earnings report from Accenture, a company that helps businesses digitize their operations. Accenture should have a “solid handle” on artificial intelligence and whether the hype holds any weight, he said.

The Personal Consumption Expenditures price index, or PCE, is released on Friday, and Cramer cited it as one of the central bank’s favorite metrics for measuring inflation.

“I’m laser-focused on inflation here because buyers still seem to be reluctant to step up until this tightening cycle’s over. And we’re now witnessing a classic move toward bonds given that interest rates have gotten to levels we haven’t seen in 17 years,” Cramer said.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Ford and Costco.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com