KARACHI – Several customers of Pakistani Bank faced unwanted situation as they lost money after falling victim to data breach that caused unauthorized transactions from their debit cards.

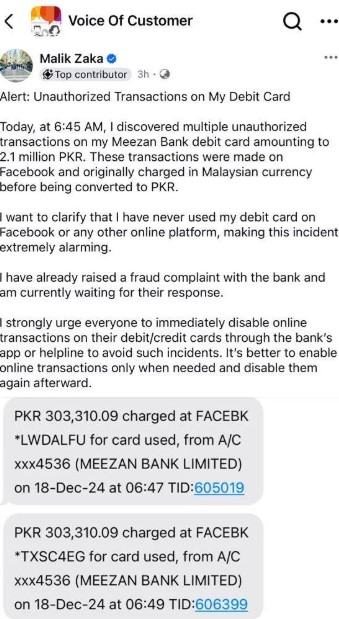

It started with posts of bank users in Voice of Customer groups, where victims shared screengrabs of fraud transactions from their account. Victims said these transactions were made in Malaysian currency before being converted into local currency. The purchases were made from their debit cards through social media platforms.

As the posts garnered massive response from social media users, the Karachi based bank reimbursed at least ten customers who were affected by unauthorized debit card transactions. Meezan Bank cleared air that its systems remain secure, linking fraudulent transactions to customers sharing sensitive information on apps that bypass OTP verification.

The fraud transactions raised concerns about increasing prevalence of cybercrime in Pakistan, with government proposing amendments to the Prevention of Electronic Crimes Act (PECA) 2016.

Guide to avoid third-party app breaches on bank cards

Trusted Apps Only

Download apps only from official sources (Google Play, Apple App Store) and verify their reviews.

Always go for Two-step Authentication

Add an extra layer of security to apps that support it.

Keep an eye on Transactions

Check your bank account for unauthorized transactions and set up transaction alerts.

Restrict App Permissions

Restrict unnecessary app permissions, like access to contacts or camera.

Use Official Bank Apps

Try using bank’s official app for transactions and account management for payment transfers.

Public Wi-Fi

Use VPN or avoid using public Wi-Fi for financial transactions.