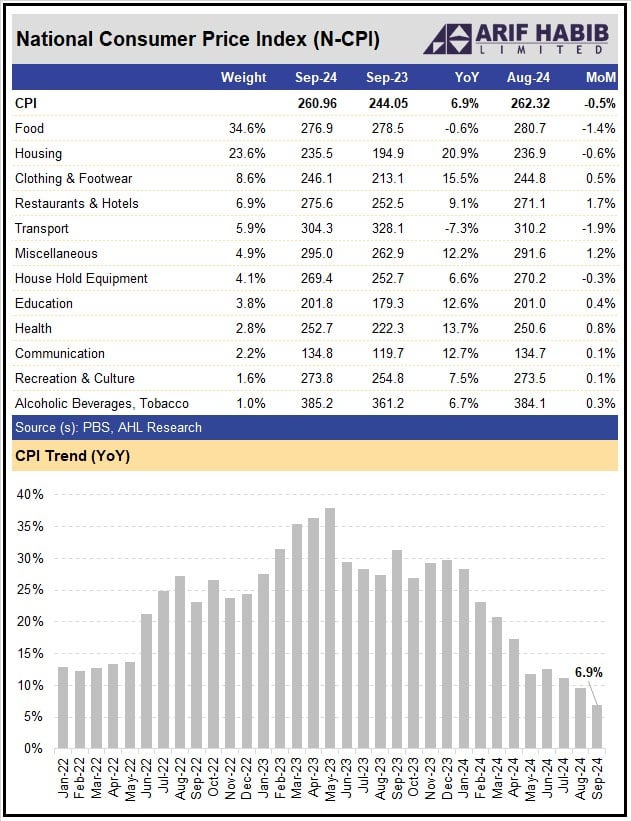

Pakistan’s Consumer Price Index (CPI) inflation slumped to 6.9% year-on-year in September, its lowest since January 2021 and down from 9.6% in August, data from the Pakistan Bureau of Statistics showed on Monday, mostly owing to a high base effect, lower commodity prices, and a stable currency.

The PBS data, released on Tuesday, showed that on a month-on-month basis inflation fell 0.5% in September as against an increase of 0.4% in the previous month.

The country’s annual consumer price inflation rate slowed to 9.6% in August, the first single-digit reading in almost three years, which analysts have widely pinned on the fact that the currency has remained stable over the past 12 months.

The inflation figures significantly outperformed both market expectations and official consensus, as the finance ministry’s last monthly economic outlook had projected inflation to slow to around 8-9% in the next two months (September-October).

This drop makes the case for a further easing of monetary policy by the central bank even stronger. State Bank of Pakistan cut its key policy rate by 200 basis points to 17.5% last month, making it the third straight reduction since June as the country looks to spur growth as inflation eases.

“Due to aggressive monetary tightening, SBP has achieved in bringing inflation below 7% one year ahead of target,” said Mohammad Sohail, chief executive officer at brokerage Topline Securities.

According to analysts as disinflation is anticipated to lose more steam down the line, mainly on the back of high base effect and dropping global commodities, the SBP will have room to keep lowering the policy rate.

Dr Khaqan Hassan Najeeb, former adviser to ministry to finance, said Pakistan’s disinflationary trend was supported by several factors: a high base effect from last year’s inflation spike, a decline in global commodity and oil prices, and a stable exchange rate in the country.

“Tight monetary policy, has curbed demand and also helped in curtailing inflation,” the economist said adding, “The critical point is that the real interest rate is now near 11 %, which gives room to ease monetary policy in the country.”

Pakistan struck a deal last month with the International Monetary Fund (IMF) for a $7 billion loan programme that includes tough measures such as higher taxes on farm incomes and electricity prices.

The prospect of such moves has worried poor and middle-class Pakistanis. But inflation has started moving on a downward trend, albeit from a high base.

Economic indicators have stabilised in the South Asian nation since last summer when the country came close to a default before a last-gasp bailout from the IMF.