Last Updated:

From February 1, 2026, cigarette prices may rise as new excise duties are based on length, with longer cigarettes facing higher taxes and likely steeper price hikes for consumers.

For short cigarettes with a length of up to 65 mm, the excise duty works out to roughly Rs 2,700 to Rs 3,000 per 1,000 sticks, depending on the category. This is the lowest tax slab.

Cigarette Excise Duty Hike: From February 1, 2026, cigarette prices are likely to move higher after the government notified revised duties on cigarettes and other tobacco products. While the headline tax number has drawn attention, the actual impact on consumers depends on one key factor — the length of the cigarette.

According to CNBC-TV18 citing sources, cigarette prices are likely to be increased by 20-30 per cent after the duty hike.

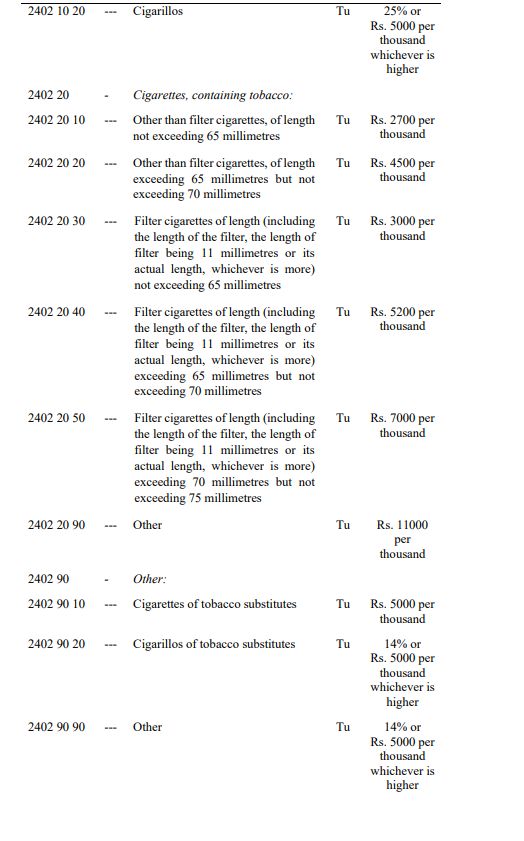

Under the new structure, cigarettes are taxed based on their length in millimetres and whether they are filtered or non-filtered. Simply put, longer cigarettes attract a higher tax, which eventually feeds into retail prices.

How cigarettes are taxed by length

For cigarettes with a length of up to 65 mm, the duty works out to roughly Rs 2,700 to Rs 3,000 per 1,000 sticks, depending on the category. This is the lowest tax slab and typically applies to shorter sticks.

Cigarettes that are longer than 65 mm but do not exceed 70 mm fall into a higher tax bracket, with the duty rising sharply compared with shorter variants.

For cigarettes measuring more than 70 mm and up to 75 mm, the tax burden jumps to around Rs 7,000 per 1,000 sticks, making these significantly more expensive to manufacture and sell.

The highest levy applies to the “other” category, which attracts a duty of Rs 11,000 per 1,000 sticks. This category generally captures longer or differently designed cigarette products that do not neatly fit into standard slabs.

In simple words, the longer the cigarette, the higher the tax burden.

What does this mean for retail prices?

While companies have not yet announced price hikes, the duty structure offers a clear indication of the pressure on prices.

At a basic level:

A tax of Rs 2,700 per 1,000 cigarettes translates to roughly Rs 2.7 per stick.

A Rs 7,000 per 1,000 duty works out to about Rs 7 per stick.

A Rs 11,000 per 1,000 levy means nearly Rs 11 per stick in tax.

Also Read: Cigarette Excise Duty Hike: ITC Stock Declines To 21-Month Low On Block Deal, Tariff Rise

This does not automatically mean retail prices will rise by the same amount. Cigarette makers may choose to absorb part of the increase to protect volumes, especially in mass-market brands. Alternatively, companies could pass on the higher cost to consumers gradually through phased price hikes.

Will your cigarette get more expensive?

That depends on what you smoke.

Shorter cigarettes are likely to see relatively smaller price increases, while longer and premium variants face a much higher tax hit, making price hikes more likely in those categories.

For consumers, the key takeaway is simple: cigarette length now plays a bigger role than ever in determining how much you pay at the counter.

Disclaimer: Smoking is injurious to health.

January 01, 2026, 12:11 IST

Read More