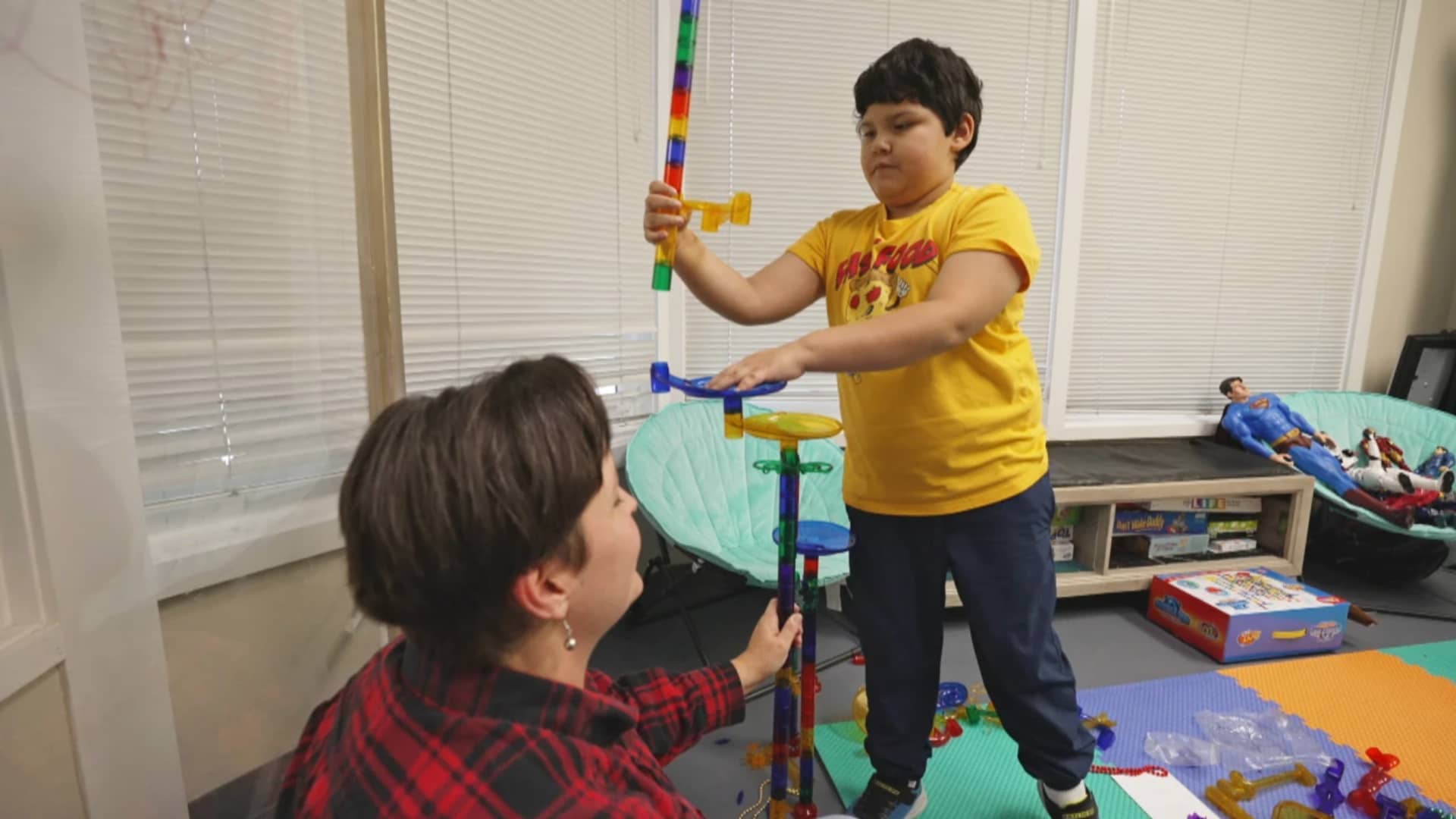

Misty Richard and her son, Javier “J.J.” Bautista.

NBC News

Like many parents of autistic children, Misty Richard was thrilled in 2017 to find a clinic close to her home in Baton Rouge, Louisiana, that could help her son, Javier Bautista, known as J.J. The facility was operated by the Center for Autism and Related Disorders, a nationwide company that had 265 locations at its peak. Known as CARD, the center specialized in Applied Behavior Analysis, an individualized program that uses reinforcement strategies to help autistic children cope, learn and communicate.

Initially, J.J., now 9, did well at the clinic. But after CARD was acquired by the Blackstone Group in 2018, a prestigious private-equity firm in New York City, Richard said she began to see troubling changes in staffing. Still, she kept her son at the clinic.

Then, in June 2022, J.J. came home one day agitated about thunderstorms, a deep-seated fear for him. The weather was clear, so Richard asked clinic officials if anything had happened with her son that day to stir his distress. After repeated emails asking for details that Richard said the clinic only reluctantly provided, she was shown a video of her son in a therapy session with a staffer flipping the lights on and off in the room, apparently to mimic lightning. In the video, J.J. was visibly upset by the staffer’s action, Richard said.

“It’s stressful for me to watch my child be so upset when he had not a care in the world,” Richard told NBC News. Finally, she said, “they tried to say it was part of an emotional lesson to help him identify what he was scared of.”

Richard withdrew J.J. from the facility and filed a complaint with the Louisiana Behavior Analyst Board, reviewed by NBC News, that identified the CARD staff member who had been flicking the lights. On Feb. 21, the Behavior Analyst Board disciplined that person, its website shows, for sending messages “stating her intention to provoke” a client at the clinic and for ignoring the client’s demand “to stop an action that was agitating and provoking the client.” Under a consent decree, the staffer, a behavior analyst, agreed to perform 30 hours of continuing education, reimburse the board $5,000 for costs and not apply to reinstate her lapsed license until January 2025.

A Blackstone spokesman said he could not comment on a particular client but said the firm was “never involved in determining the appropriate course of treatment for patients.” Moreover, Blackstone “expected behavioral therapists and clinical supervisors to adhere to the highest levels of care — and any instance where that did not occur at the local level would be completely unacceptable,” he said.

Misty Richard withdrew her son from an autism treatment center in Louisiana and filed a complaint with a state board.

NBC News

As autism diagnoses have soared in the U.S. in recent years, an army of businesses have sprung up to serve the children who have received them. In 2020, 1 child in 36 were diagnosed with the condition, up from 1 in 150 in 2000, according to the Centers for Disease Control and Prevention. People diagnosed with autism, a neurodevelopmental disorder, typically have trouble with social communication and interactions; some are nonverbal, making it difficult for them to convey their feelings.

Many of the companies swarming the autism services industry are backed by private-equity firms. These entities use borrowed money to buy companies they hope to sell quickly for more than they paid. The industry has taken over a vast array of health care businesses in recent years, even as research has shown that patient care declines at some entities run by private-equity firms. A recent study by academics at Harvard University and the University of Chicago, for example, found that patients at hospitals owned by private-equity firms experienced far more infections and falls. And on March 5, the Federal Trade Commission and Department of Health and Human Services announced an inquiry into private equity and other corporate takeovers of healthcare entities to understand how the transactions might “increase consolidation and generate profits for firms while threatening patients’ health, workers’ safety, quality of care, and affordable health care for patients and taxpayers.”

Among buyouts of autism services companies from 2017 to 2022, 85% were done by private-equity firms, according to Rosemary Batt, a professor at Cornell University’s School of Industrial and Labor Relations. With Eileen Appelbaum, co-director of the Center for Economic and Policy Research, Batt co-wrote a study: “Pocketing Money for Special Needs Kids: Private Equity in Autism Services.” The research estimates that some 135 private-equity firms invested in for-profit companies providing ABA therapy. Because these companies are private, it is difficult to determine the total market share the firms control in autism services, but the top 12 private-equity-backed companies employed 30,000 people and controlled almost 1,300 locations nationwide, Batt and Appelbaum found.

The autism services industry generates revenues of $7 billion a year, and Applied Behavior Analysis, the therapy J.J. received at CARD, is the most popular service offered. Typically requiring intensive and costly therapy sessions of up to 40 hours a week, it is covered by private health insurance and Medicaid in all 50 states. A year of ABA treatment can cost up to $60,000 per child, according to the CDC.

J.J. Bautista, now 9, initially did well at a Center for Autism and Related Disorders facility.

NBC News

When Blackstone bought CARD in 2018, it promised to “expand access to treatment and services for those affected by autism.” But five years later, in May 2023, CARD filed for bankruptcy, having shuttered over 100 facilities in several states, stranding families that were relying on their services.

Blackstone’s spokesman denied that its ownership had caused the quality of care at CARD to decline and said in a statement that the company’s financial straits were the result of “well-documented, industry-wide challenges stemming from the crushing impacts of the pandemic and its aftershocks and insufficient reimbursements from insurers.” He added that nearly 80% of the purchase of CARD “was funded with equity and any debt financing was intended to support the company’s growth.”

The pandemic savaged many health care operations, to be sure, but the increased debt that private-equity firms typically load onto the companies they buy raised the companies’ costs, making Covid’s hit even more of a challenge. CARD, for example, went from having no debt to carrying $160 million when it filed for bankruptcy.

Other private-equity-backed autism services providers have restructured, shut down some operations and slashed services in recent years. But among the larger providers backed by private-equity firms, CARD appears to be alone in filing for bankruptcy.

“The private equity people saw the big picture, they saw the dollar signs, the money” in the treatments, said Jon Bailey, emeritus professor and an expert on ABA therapy at the University of South Florida in Tallahassee. “Now they’re discovering they can’t make as much money as they thought they could.”

For ongoing CARD customers, things seem to be improving. The company’s founder, Doreen Granpeesheh, bought back most of its operations last August. A psychologist and board-certified behavior analyst, she told NBC News she’s dedicated to reviving the company’s services.

The Center for Autism and Related Disorders had 265 locations nationwide at its peak.

Courtesy: CARD

“A lot of senior clinicians who had been at CARD before and had left over the last five years have now come back,” Granpeesheh said in an interview. “Our goal and our promise to our families is that we are going to put the clinical quality ahead of everything else.”

The Blackstone spokesman said in a statement that returning CARD to its founder was the right thing to do, “so she could keep its existing center-based facilities open for patients.”

‘Clinics run by businesspeople’

Applied Behavior Analysis grew out of research published in 1987 by Ivar Lovaas, a UCLA psychologist. In a study, Lovaas found that nine of 19 children receiving ABA intervention for up to 40 hours a week for two years or more made substantial progress in 10 intellectual and language skills. Subsequent research by others presented similar findings and the industry took off.

Twenty years later, as autism diagnoses were rising nationwide, parents began pushing for ABA therapy and other services to be covered by Medicaid and private insurance. South Carolina and Texas were among the first to mandate coverage in 2007; by 2019, all 50 states were aboard. In 2014, the Centers for Medicare and Medicaid stated that Medicaid must cover medically necessary services for autism.

Although there are several treatments for autism related disorders, including speech and occupational therapy, ABA has become the default recommendation made by many pediatricians when autism is diagnosed, experts in the field say. Some other therapies are not covered by insurance in all states — one reason why private-equity firms have focused their buyouts on ABA therapy companies, Batt and Appelbaum say.

Facilities offering ABA services are typically overseen by a board-certified behavior analyst who assesses each child’s needs and develops individual treatment plans. Once enrolled in a program, a child attends therapy sessions conducted by a registered behavior technician based on those needs. While board-certified behavior analysts receive a graduate level certification, registered behavior technicians need only attain a high school diploma, go through a background check and complete 40 hours of training. They are not licensed by the states in which they operate.

Employment in the field has exploded. According to the Behavior Analyst Certification Board, there are 66,339 board-certified behavior analysts in the U.S., up from 16,376 in 2014. The number of registered behavior technicians has also rocketed, up from 328 a decade ago to more than 160,000 today.

Some researchers question ABA therapy’s effectiveness. In 2020, a report from the Department of Defense, which paid $370 million to cover therapy costs for service-members’ children in 2019, found “limited evidence” of better outcomes using ABA therapy.

Private equity’s sizable investments in ABA therapy extend well beyond Blackstone’s purchase of CARD, and these investments across the industry trouble experts in the field. One is Pablo Juarez, a senior associate in pediatrics, psychiatry and behavioral sciences, and special education at the Vanderbilt University Medical Center. He said that behavior analysts tell him parents of autistic children are pushed into paying for 30 to 40 hours of treatment each week because it generates more profits to the clinics. As co-director of TRIAD, the Treatment and Research Institute for Autism Spectrum Disorders at Vanderbilt, Juarez said he sees this practice more among private-equity-backed clinics.

“These clinics are run by businesspeople, and scheduling patients for smaller periods of time is more labor intensive and diminishes profits,” Juarez said. “I have heard from some behavior analysts that although they may suggest 10, 15, 20 hours a week after the assessment of a new child at a clinic, they come back from meeting with clinic managers and say the child is getting 40 hours.”

This was not the case at CARD, Blackstone said, citing an average of 12 hours per patient per week during its ownership.

‘Fast Food ABA’

For the past decade, Bailey of the University of South Florida has run an ABA Ethics hotline, giving him a bird’s-eye view, he said, of problems in the growing industry. Hotline complaints about private-equity-backed companies have been numerous and persistent, Bailey said.

“The original idea was to answer questions, but it quickly moved to complaints about ethics at the company the person worked for,” he said. “People would say, ‘They’ve increased my case load, it’s almost double what it was when I was hired on.’ In order to make more money, the private equity-owned company ups the number of cases, decreases the amount of supervision, and the next thing you know, this is not about treatment, it’s about how many hours we can get.”

Michelle Zeman, a board-certified behavior analyst who is autistic, agrees. “These are financial people who don’t understand the needs of our clients,” she said. “They’re not about helping out the community.”

After private-equity buyouts of ABA centers, staffing, training and supervision at clinics decline, undermining the quality of care, the researchers Batt and Appelbaum found. As a result, they suggest that states implement new minimum client-staff ratios at clinics and increase oversight of the industry.

Other independent research shows a decline in care after private-equity firms buy up health care entities. For example, academic research on nursing homes from 2021 showed 10% higher mortality rates at facilities owned by private-equity firms.

The private-equity firm Blackstone bought the Center for Autism and Related Disorders company in 2018. CARD filed for bankruptcy five years later.

Courtesy: CARD

The Blackstone spokesman said clinical training at CARD “significantly increased” during the firm’s ownership. But two employees disputed this. They provided a document showing that in 2016, two years before Blackstone took over, average total training time for behavior technicians at the company was 86 hours, with the training lasting an average of five to six weeks. By 2020, after Blackstone’s takeover, total training time had fallen to 36 hours and the average duration was 15 days, the document showed.

Even though the private-equity experiment with ABA therapy has hit roadblocks, the financial firms continue to target providers for acquisition. Zachary Stevens, a board-certified behavior analyst and the clinical director of Practical Behavior Analysis in Nashville, Tennessee, says that in the recent past he received phone calls and emails every week from private-equity-backed companies hoping to buy his operation. The calls have slowed down a bit, but they still come, and he said he always says no and tries to explain why.

“I tell them: ‘You are asking people who care about other people to conform to a model of therapy that is exploitive of an autism diagnosis,'” he said. “Saying your child needs 30 hours a week of therapy stands on pretty weak ground, but they have taken that and made that the rule of the land for their clinics. They’re creating fast food ABA.”

Elemy is an in-home ABA provider backed by several venture capital firms. Last year, the company pulled out of most of the states it operated in because the centers there were not profitable, laying off staff and abandoning customers. Zeman, the board-certified behavior analyst, said she worked briefly at Elemy and provided NBC News with texts about the downsizing sent to Elemy staff by its founder, Yury Yakubchyk, in 2022.

“After a detailed review, we have decided to focus providing world-class care in the California, Texas and Florida states only as we prioritize on driving long-term company efficiency through better software and process-driven experiences,” one text said.

The downsizing at Elemy “was heartrending” for both customers and staff, Zeman said. “This is a field that should not be about how much money you bring in.”

Elemy did not return phone calls seeking comment.

‘An entity, not a bank account’

Meanwhile, Granpeesheh, who founded CARD in 1990 and spent the next 25 years building it into the largest autism services provider in the country, is back at the helm.

Selling to Blackstone in 2018 was a decision she said she made because the firm was “very big, had a lot of resources and during the interview process it felt like they would be good friends, partners who would bring wisdom to the game.”

Granpeesheh remained on the company’s board until early 2022, but said she quit after a series of disagreements with new management about where they were taking the company. During her time on the board, Granpeesheh said the company added costly executives, increased CARD’s debt and struck expensive contracts with third-party providers. The new CEO had no experience in autism services, she said; he had run a kidney dialysis company, his LinkedIn profile confirms. Blackstone noted that the chief clinical officer under its ownership was a longtime CARD employee.

Doreen Granpeesheh, founder of the Center for Autism and Related Disorders, bought back most of its operations in July.

NBC News

By 2022, the salaries of the company’s behavior techs working with clients had not gone up since 2019, she said. Employees started leaving — the average number of behavior techs at each clinic had been 20 when she owned the company, Granpeesheh said, but at the end of Blackstone’s ownership, it had dwindled to 11.

It was during this time that Richard’s son J.J. attended the CARD clinic near Baton Rouge. Granpeesheh said she was sorry about J.J.’s experience there. “I did have a number of parents reach out to me and tell me stories that I would have been pretty upset about if I was in a position to make any kind of change at CARD during those years,” she said.

Blackstone’s spokesman said any changes in the number of behavior techs reflected the impacts of the pandemic.

In July, with CARD in bankruptcy, Granpeesheh bought back most of its operations for $25 million and took on some of its debt. Now overseeing 112 facilities, Granpeesheh is working to rebuild the company; she said she’s hired more than 500 new behavior technicians and taken on 225 new patients.

“You have to watch over the company,” she added. “It is an entity, not an endless bank account.”

In Baton Rouge, J.J. attends a new autism services clinic and is thriving there, his mom said. It is not owned by private equity.