ISLAMABAD:

In a significant development, the government and representatives of commercial banks have initiated discussions to prepare a plan for the debt restructuring of Pakistan International Airlines (PIA) with the aim of keeping the struggling airline operational for another six months with a limited number of flights.

The 12-member committee consists of an equal number of representatives from the federal government and commercial banks, according to sources within the Ministry of Privatisation. They reported that the committee held two meetings on consecutive days and has been tasked with finalising the debt restructuring plan within two weeks.

Officials from the Ministry of Privatisation disclosed that the committee has also been assigned the responsibility of formulating a plan for an immediate borrowing of Rs15 billion by PIA to address its urgent needs, including fuel costs. The monthly cost of fuel to keep existing routes operational is estimated at Rs8.5 billion.

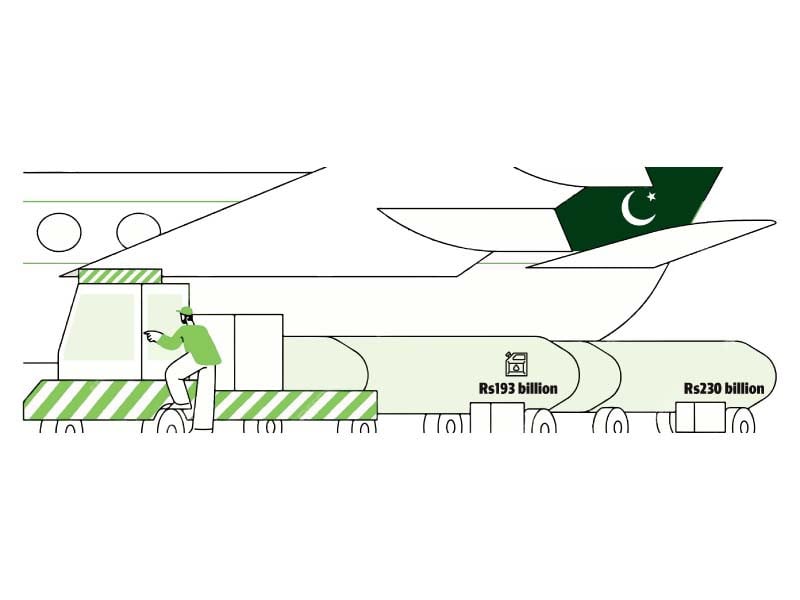

Usman Bajwa, the newly appointed Secretary of the Privatisation Commission, has been designated as the committee’s convener. The committee includes representatives from the Ministry of Finance, PIA, and six commercial banks. As of the end of August, these six banks have collectively provided Rs230 billion in loans to PIA, including Rs193 billion in domestic debt.

Bajwa did not respond to requests for comments.

Last month, PIA requested a moratorium on its Rs260 billion domestic debt repayments to address an annual deficit of Rs153 billion, which is the shortfall between its sales and essential expenditures. PIA requires Rs3.1 billion per month to service its external debt of Rs109 billion and Rs7.5 billion for servicing its domestic debt of Rs260 billion as of the end of August. The airline, Pakistan’s single highest loss-making entity, obtained an additional loan of Rs13 billion last month.

The Bank of Punjab has the largest exposure, with over Rs56 billion in loans to PIA, followed by Askari Bank Limited with Rs43 billion, JS Bank with Rs34 billion, NBP with Rs33 billion, Faysal Bank with Rs32 billion, Habib Bank Limited with Rs29 billion, and Bank Islami with Rs22 billion. Albaraka Bank has provided a Rs9 billion loan, and Soneri Bank’s exposure to PIA is Rs5 billion, according to sources.

PIA’s accumulated losses have reached Rs713 billion, with Rs285 billion worth of loans directly guaranteed by the federal government, not including loans obtained by PIA’s subsidiaries.

In a baseline scenario, PIA’s debt and liabilities would soar to Rs2 trillion, and its annual losses would increase to Rs259 billion per annum by 2030, according to PIA management.

The committee includes members from the corporate and investment banking divisions of several banks, including HBL, NBP, Bank of Punjab, Meezan Bank, Askari Bank, and Faysal Bank, according to Ministry of Privatisation officials.

The Technical Committee will assess PIA’s exact financing requirements from October 2023 to March 2024 for optimal operations. There are no plans to run all of PIA’s operations, with only essential routes being kept operational, according to Ministry of Privatisation officials.

Over the weekend, PIA grounded more than 80 domestic and international flights due to fuel shortages.

Sources stated that PIA immediately needs Rs15 billion to remain operational, but commercial banks are reportedly reluctant to provide the loan in the midst of discussions about debt restructuring. Discussions to secure the necessary funds are ongoing.

The government has initiated the process of privatising PIA through international competitive bidding. In the first phase, it is in the process of hiring a financial advisor to prepare a transaction structure. The government aims to sell a debt-free PIA, preferably to domestic buyers.

PIA currently has 34 aircraft, but only 19 are operational. Of the 15 grounded aircraft, six are leased by PIA and incur a monthly charge of $2 million.

PIA has also separately requested a Rs7.5 billion budget support grant from the federal government, but the Ministry of Finance is reluctant to provide it in the absence of a viable plan.

The request for the grant is to settle a deal of $26 million with Asia Aviation Capital Limited (AACL), which, in 2015, leased two A-320 aircraft to PIA for six years. Last month, PIA received a court notice for immediate payment of $31.3 million for outstanding rent, re-delivery rent, maintenance reserves, and interest charges for the two aircraft.

PIA is attempting to reach an out-of-court settlement with AACL for $26 million, with approval reportedly granted by Prime Minister Anwaarul Haq Kakar, according to sources.

The finance ministry is no longer inclined to cover the costs and has requested that PIA handle its commercial dealings on its own.

As is often the case, PIA has warned that if legal matters with AACL are not resolved and an adverse court decision is reached, its aircraft and foreign hotels could be confiscated.

PIA has been managed in an unprofessional manner and has largely been sustained by state bailouts. However, the Finance Ministry has now exhausted its resources due to an overarching macroeconomic crisis.

Published in The Express Tribune, October 25th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.