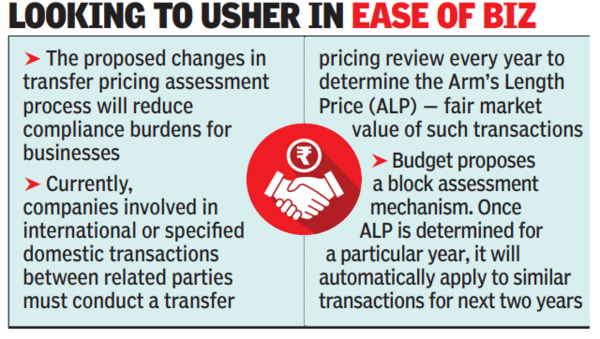

MUMBAI: Budget 2025 has proposed changes in the transfer pricing (TP) assessment process to reduce compliance burdens for businesses and streamline tax administration. TP assessments can sometimes result in long-drawn litigation.

At present, companies involved in international or specified domestic transactions between related parties must conduct a transfer pricing review every year to determine the Arm’s Length Price (ALP) – the fair market value of such transactions. However, authorities have noted that many businesses engage in similar transactions year after year with little variation in terms of partners, transaction volume, or pricing. As a result, the same analysis is repeated annually, creating unnecessary paperwork for businesses and tax officials.

To address this, the budget proposes a block assessment mechanism. Once the ALP is determined for a particular year, it will automatically apply to similar transactions for the next two years. Business entities wishing to opt for the block assessment must submit a request and the transfer pricing officer will within a month decide on the validity of the request.

A new provision will allow tax authorities to adjust a company’s income for the two subsequent years based on the previously determined ALP. The revised income calculations must be completed within a specified time frame.

While transfer pricing experts and industry representatives have welcomed the move, they point out the need to read between the lines.

Mitesh Jain, partner at the law firm of Economic Laws Practice said, while the amendment appears to be a welcome initiative, implementation of the same may be a ‘double-edged sword’ for taxpayers. Once the taxpayer has opted for such ALP determination, the same will be binding for next two years. Thus, if the transfer pricing officer and assessing officer makes any TP adjustments in the first year, these will apply the subsequent two years even if the cases for the two years are not selected for scrutiny or referred to TPO.”

Aayush Nagpal, tax partner at Shardul Amarchand Mangaldas, added, “Introduction of this legislation suggests relief from year-on-year litigation, however, the rules may through light on the unanswered questions including the approach of the transfer pricing officer to resolve the matters, scope of appeal with the taxpayers, fate of new transactions along with the process for corporate tax assessment matters in the second or third year under the block. Govt has introduced these provisions in line with the bigger objective of ease of doing business and enhancing tax certainty, so it is expected that the rules will clear any ambiguity.”